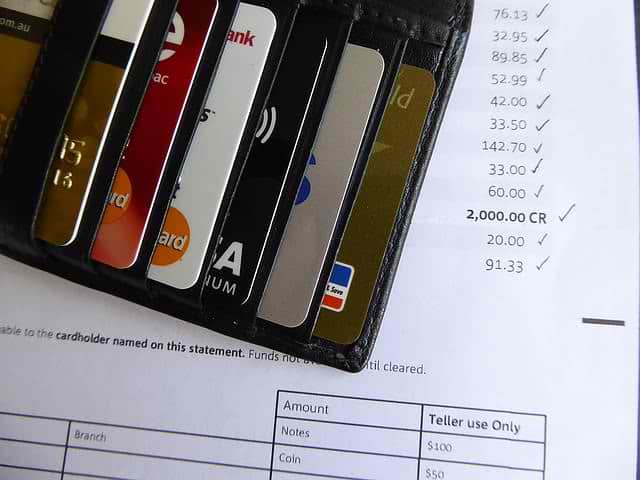

Are you looking for debt alleviation? If you are frequently stressed over intensifying financial obligations, there are several alternatives for financial debt alleviation.

Certainly, getting out of financial obligation is one of the very best points you can do for yourself. Being debt-free offers you a feeling of flexibility and comfort. You do not need to bother with lenders incessantly calling you. You do not have to panic concerning missing the target dates yet once more for bank card bills and also utility bills. You do not have to deal with rising interest rates, late cost costs as well as charges.

Financial obligation can be very limiting. It limits your selections in your job life or in starting a service. You require to pay it off as well as break free from it. Below are some tips on how you can offer on your own financial obligation alleviation.

Establish a Payment Plan

If you are established concerning leaving financial debt and attaining economic flexibility, it is essential for you to develop a layaway plan. You should not just think of exactly how it would certainly be excellent to lastly be monetarily cost-free, you need to do something about it. You need to make a strategy and also execute it. Don’t be afraid about developing a strategy. A lot of people are reluctant to make a plan because they are afraid to compute all their financial debts.

Dealing with the precise money amounts can be intimidating as well as depressing. However, encountering your duty and understanding that you are attempting to do something to eliminate your financial obligation will likewise provide you a sense of alleviation. It is much better than doing nothing. Producing an activity plan will certainly help encourage and also equip you. You must be proud that you are taking actions to settle your financial debt.

Government Grants

The UNITED STATE Federal government web site features grants that fall under the groups of government advantages, trainee car loans and also small business start-up financings. Each category brings up various programs and also alternatives. This might not indicate cash in your pocket, but these grants help in reducing your expense of living. Inspect if you can get approved for these gives. Certain documents may be required prior to approval.

Debt Negotiation

Debt negotiation is a process in which the debtor as well as financial institution will bargain and agree on a reduced equilibrium that will certainly be taken into consideration as repayment in full. You just settle a percentage of the total financial obligation owed as the last settlement amount. Call your lender to discuss a negotiation. Check out this related site to learn more tips on how to pay your debts.

Debt Combination

Debt combination is a method that involves securing one loan to repay various other existing fundings. All your financial debts are therefore combined into one, allowing you have a lower regular monthly interest rate and giving you the comfort of servicing just one loan. Look for a trustworthy financial obligation consolidation firm if you are considering this choice.

Credit Score Therapy Services

A credit score counselor will certainly provide you suggestions on exactly how to tackle financial debt relief loan consolidation or various other measures. There are credit history therapy agencies that can assist you discuss with your financial institutions. You will certainly additionally be provided tips on finance. Make sure to discover a respectable credit scores therapy firm.

Change Your Spending Routines

Establish a spending plan, restrict your costs as well as adhere to your debt payment plan. Live listed below your means. By changing your spending routines, you will certainly also transform your financial expectation.